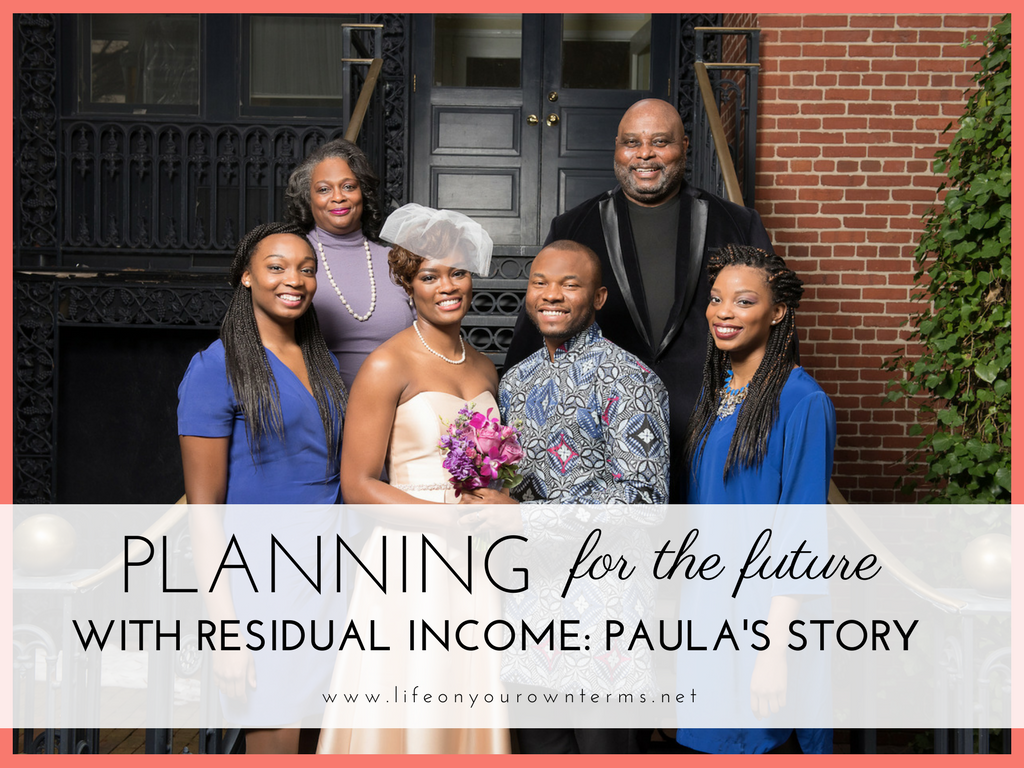

Today you will hear Paula Jordan’s story of how she came to the Life on Your Own Terms team as a result of her search for residual income. She has been a part of our team since April 2017, and has achieved quick success due to her coachable attitude and her focus on helping others.

My husband and I have been married 28 years, and by many standards, we have been quite successful. We’ve raised 3 amazing daughters, 2 of whom received full athletic scholarships to college and the other who is attending an Ivy League school and playing basketball there.

My husband is a contract attorney, and I have my own medical billing business. We both love our work and don’t plan on retiring anytime soon. However, once our girls moved out of our home, we realized that we wanted to begin planning for the future with residual income.

As much as we both love our work, we know that the income won’t continue if we stop working. We wanted to have another stream of income to give us freedom and flexibility in our future. We enjoy traveling and visiting our daughter who works for the state department, so we want to be able to do that over the coming years.

My Search for Residual Income

In my quest for residual income, I began looking at different MLM companies and finally settled on one. It appeared at first glance that it was going to be a great financial opportunity. So when I reconnected with Beth and we decided to get coffee, I was excited to share my new business with her.

When I met with Beth, I shared with her why I had started with this business and that my goal was to have residual income for the future. She asked me if I would be willing to look at what she was doing with the Life On Your Own Terms team.

I agreed, and as she shared the information about her company, I recognized that her company was different. Unlike the MLM I had joined, which shared a lot of hype but not a lot of real numbers or results, what Beth was sharing was real.

I saw that the product line provided a large variety of products that appealed to a broad spectrum of people. In addition, I saw that the company was truly dedicated to helping people improve their lives – both physically and financially.

Not only that but since I had known Beth for over 17 years, I knew she was credible and had integrity. Our relationship was the foundation for our connection and trust. It was an easy decision for me to join her team and begin building a business.

Just one month after joining the team, I attended the company’s national convention. I was expecting to see a lot of hype like I had seen in my previous company. Instead, I was impressed by the professionalism and substance provided.

A Bright Future

This business has helped me to step up and become a stronger leader. I’ve been able to reconnect with old friends, which has been such a joy. I believe that relationships are the key to a strong business, so I spend a lot of my time building connections with others.

This business has helped me to step up and become a stronger leader. I’ve been able to reconnect with old friends, which has been such a joy. I believe that relationships are the key to a strong business, so I spend a lot of my time building connections with others.

I love that with this business, I’m making a difference in my community, my church, and my neighborhood. I’m helping people make healthier decisions and changes in their lives.

Since joining the team just a few months ago, I’ve already received some great paychecks. But I’m more excited about the long-term: I know that if I build this business consistently, I will be prepared for the future with residual income.

Paula and her husband Daryle have been married 28 years and have 3 grown daughters: Samantha, Ryan, and Sydney. Paula and Daryle hope to take a hand dance class together soon. Paula’ hobbies include visiting Princeton to watch her youngest daughter play basketball in the winter, reading fiction, and traveling internationally to visit Samantha and her husband Guillaume.

Paula and her husband Daryle have been married 28 years and have 3 grown daughters: Samantha, Ryan, and Sydney. Paula and Daryle hope to take a hand dance class together soon. Paula’ hobbies include visiting Princeton to watch her youngest daughter play basketball in the winter, reading fiction, and traveling internationally to visit Samantha and her husband Guillaume.